Creating Alpha

By finding high return investment opportunities in public equities in India, while remaining guardians of our capital and managing through risks.

Return

(Since Inception in Jan-20)

(Since Inception in Jan-20)

*As of October-25. Before taxes, fees and expenses to make it comparable to Sensex. Includes periods before getting AIF approval.

Indian Economy

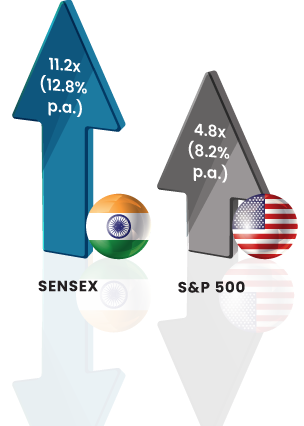

India’s remarkable growth over the last 20 years has positioned it as one of the most attractive Emerging Markets globally.

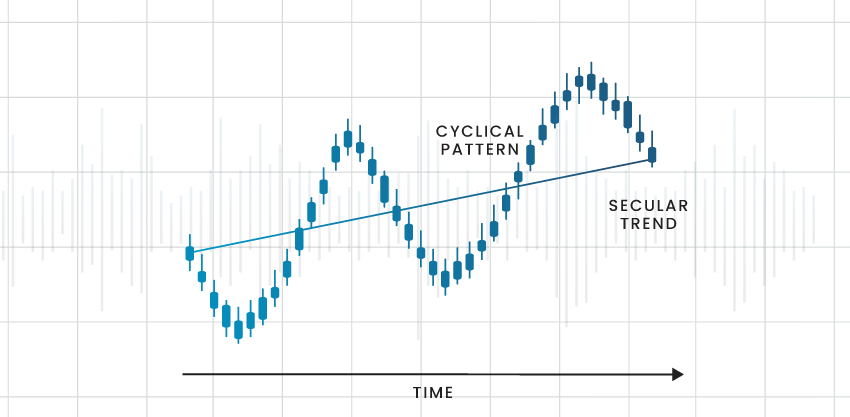

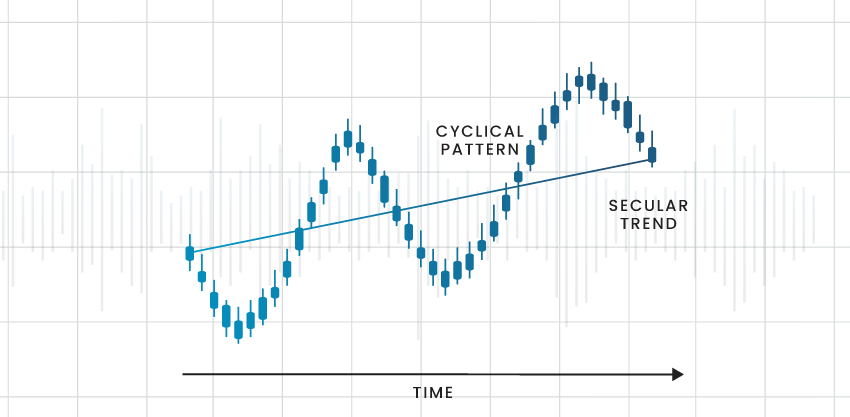

In addition, the market offers substantial opportunities for Sector Selection and Timing

Indian Economy

India’s remarkable growth over the last 20 years has positioned it as one of the most attractive Emerging Markets globally.

In addition, the market offers substantial opportunities for Sector Selection and Timing

Guardian Capital Partners Fund – Opportunities Scheme

We are a public equity long-only fund, picking stocks based on bottom-up fundamental research. We are structured as an open-ended, Indian-domiciled Category III AIF.

The Team

Manav Saraf and Kabir Kewalramani are the two CIOs of the Fund. They started their careers together about 25 years ago. They bring their Indian private equity experience with large global funds to the public equity discipline. They have invested a substantial portion of their net worth in the Fund.

The Objective

Our investment objective is to generate 20% returns annually over any 3 - 5 year rolling period, while limiting the risk we take. We aim to deliver top quartile risk adjusted returns, measured through a high Sharpe Ratio.

The Strategy

Our investment strategy is to buy “good” companies if they are cheap, and ONLY if they are cheap. If they are not cheap, we stay on the side-lines in cash for periods.

The Style

We invest in companies that are identified as undervalued. This encompasses many styles we have used so far:

- GARP: Growth at Reasonable Price

- Cyclicals at their lows

- Contrarian investing

- Cheapness relative to a company’s own history, or its sectoral valuation

Typical Portfolio

We invest in 15-30 stocks, with the flexibility to be skewed towards a specific sector. We allocate approximately 30% to Small Caps, limit exposure to any single stock to not more than 10%, and further limit exposure to any Small Cap single stock to not more than 5%.

Guardian Capital Partners Fund – Opportunities Scheme

We are a public equity long-only fund, picking stocks based on bottom-up fundamental research. We are structured as an open-ended, Indian-domiciled Category III AIF.

The Team

Manav Saraf and Kabir Kewalramani are the two CIOs of the Fund. They started their careers together about 25 years ago. They bring their Indian private equity experience with large global funds to the public equity discipline. They have invested a substantial portion of their net worth in the Fund.

The Objective

Our investment objective is to generate 20% returns annually over any 3 - 5 year rolling period, while limiting the risk we take. We aim to deliver top quartile risk adjusted returns, measured through a high Sharpe Ratio.

The Strategy

Our investment strategy is to buy “good” companies if they are cheap, and ONLY if they are cheap. If they are not cheap, we stay on the side-lines in cash for periods.

The Style

We invest in companies that are identified as undervalued. This encompasses many styles we have used so far:

- GARP: Growth at Reasonable Price

- Cyclicals at their lows

- Contrarian investing

- Cheapness relative to a company’s own history, or its sectoral valuation

Typical Portfolio

We invest in 15-30 stocks, with the flexibility to be skewed towards a specific sector. We allocate approximately 30% to Small Caps, limit exposure to any single stock to not more than 10%, and further limit exposure to any Small Cap single stock to not more than 5%.