Guardian Capital Partners Fund – Opportunities Scheme

Delivering superior risk adjusted returns.

Return

(Since Inception in Jan-20)

(Since Inception in Jan-20)

*As of December-25. Before taxes, fees and expenses to make it comparable to Sensex. Includes periods before getting AIF approval.

Detailed Bottom-up Fundamental Research

We are a public equity long-only fund, picking stocks based on bottom-up fundamental research. We are structured as an open-ended, Indian-domiciled Category III AIF.

Investment Objective

Our objective is to generate 20% returns annually over any 3-5 year rolling period, while limiting the risk we take. We aim to deliver top quartile risk adjusted returns, measured through a high Sharpe Ratio.

Overview

Style

Style

- GARP: Growth at Reasonable Price

- Cyclicals at their lows

- Contrarian investing

- Cheapness relative to a company’s own history, or its sectoral valuation

Market Cap Limits

Market Cap Limits

We invest in equity of all sizes of companies, with about 70% in larger companies (Large and Mid-Caps) and about 30% in smaller companies (Small Caps). Even within the Small Caps’ bucket, we rarely venture into very small companies, with the average market cap of our Small Caps being around $1 billion.

Single Name Limits

Single Name Limits

We cap the exposure to any individual company at 10% of the NAV which is the SEBI limit. In addition, we limit the investment in an individual Small Cap at 5% of the NAV, which is our internal risk policy.

Sector Limits

Sector Limits

There is no restriction on the maximum allocation the fund can have to a particular sector. This flexibility allows us to capture cheapness which can be concentrated in a few sectors at a time.

Style

Style

- GARP: Growth at Reasonable Price

- Cyclicals at their lows

- Contrarian investing

- Cheapness relative to a company’s own history, or its sectoral valuation

Market Cap Limits

Market Cap Limits

We invest in equity of all sizes of companies, with about 70% in larger companies (Large and Mid-Caps) and about 30% in smaller companies (Small Caps). Even within the Small Caps’ bucket, we rarely venture into very small companies, with the average market cap of our Small Caps being around $1 billion.

Single Name Limits

Single Name Limits

We cap the exposure to any individual company at 10% of the NAV which is the SEBI limit. In addition, we limit the investment in an individual Small Cap at 5% of the NAV, which is our internal risk policy.

Sector Limits

Sector Limits

There is no restriction on the maximum allocation the fund can have to a particular sector. This flexibility allows us to capture cheapness which can be concentrated in a few sectors at a time.

Overview

Style

We invest in companies that are identified as undervalued. This encompasses many styles we have used so far:

- GARP: Growth at Reasonable Price

- Cyclicals at their lows

- Contrarian investing

- Cheapness relative to a company’s own history, or its sectoral valuation

Market Cap Limits

We invest in equity of all sizes of companies, with about 70% in larger companies (Large and Mid-Caps) and about 30% in smaller companies (Small Caps). Even within the Small Caps’ bucket, we rarely venture into very small companies, with the average market cap of our Small Caps being around $1 billion.

Single Name Limits

We cap the exposure to any individual company at 10% of the NAV which is the SEBI limit. In addition, we limit the investment in an individual Small Cap at 5% of the NAV, which is our internal risk policy.

Sector Limits

There is no restriction on the maximum allocation the fund can have to a particular sector. This flexibility allows us to capture cheapness which can be concentrated in a few sectors at a time.

How we generate 20%+ returns?

Our strategy is to buy “good” companies if they are cheap

We focus on 2 key aspects:

Promoter Quality: We review promoter pledges, analyze the balance sheet for related party transactions, working capital management, and contingent liabilities, as well as review the auditor and lead bankers. Establishing promoter quality is more challenging for Small Caps, and so we conduct a detailed reputational check by speaking with past investors, past employees, competitors, vendors, and customers. This thorough process can take many months.

Business Quality: We examine the resilience of the company’s business model by forming a sectoral view, including the company’s position in the sector’s value chain. We establish the company’s growth prospects, through the cycle RoEs, as well as the balance sheet strength and efficiency. For Small Caps, establishing business model resilience quite often requires primary research, as most of these companies operate in sub-sectors that are not well-covered by the sell side, and almost always require on-the-ground channel checks.

Buy ONLY if they are cheap

Most of the Sensex companies generate index-like returns on a 'buy and hold' basis. To generate 20%+ returns we employ a differentiated approach.

Our strategy involves buying companies only when they are cheap relative to their 'fair' valuation.

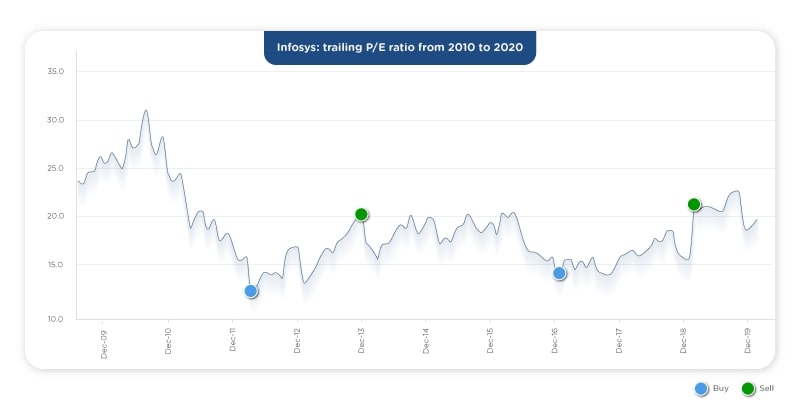

Let's take Infosys as an example. We would have purchased Infosys only twice between 2010 and 2020 when the P/E ratio was well below the 19x average and sold it when the P/E reverted to the 19x average and would have held cash for the remaining period.

So, even if we would have invested in Infosys for just 3.6 years of the 10-year period, we would have generated impressive returns of 16.2%. In cumulative terms, we would have more than doubled the money that would have been generated from the “buy and hold” strategy.

When opportunities are limited, we opt for cash

We invest when companies trade at discounts to their fair value and exit them when they start trading above their long-term average valuations, without waiting for peak valuations.

This allows us to capture up-market moves (High Up Capture Ratio), reduce our risk positions when markets are expensive, and wait in cash for opportunities when markets become cheap. We have been able to remain in cash for 2 down markets because of this strategy:

- Before Covid

- From Oct-21 to Jun-22

And this ensures that in down-market moves, our portfolio falls less than the market (Low Down Capture Ratio).

A high Up Capture Ratio and a low Down Capture Ratio combine to provide our portfolio with meaningfully higher returns than the market and a high Sharpe Ratio.

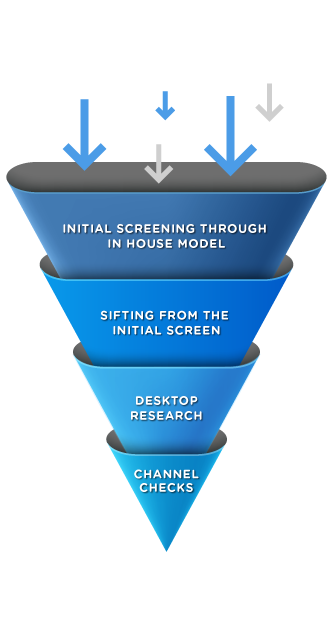

Disciplined Investment Process for Idea Generation and Detailed Research

01. Initial Screening + -

02. Sifting from the Initial Screens + -

Our CIOs discuss each of the names with the team to sift away names based on:

- Known promoter quality issues

- Balance sheet strength and efficiency

- Macro / Sector views

03. Desktop Research + -

One of the CIOs along with an analyst embarks on a comprehensive deep dive into the specific company and its corresponding sector. This research process takes around 1-2 months for a Large / Mid-Cap and takes 3+ months for a Small Cap.

04. Channel Checks + -

Disciplined Investment Process for Idea Generation and Detailed Research

01. Initial Screening

A screening model developed in-house helps us identify companies when they are showing signs of ‘cheapness.’ The highly flexible model allows us to run screens appropriate for different points in the business cycle.

02. Sifting from the Initial Screens

Our CIOs discuss each of the names with the team to sift away names based on:

- Known promoter quality issues

- Balance sheet strength and efficiency

- Macro / Sector views

03. Desktop Research

One of the CIOs along with an analyst embarks on a comprehensive deep dive into the specific company and its corresponding sector. This research process takes around 1-2 months for a Large / Mid-Cap and takes 3+ months for a Small Cap.